By Lindsay Street, Statehouse correspondent | A voucher program for special education could expand and gain more accountability as lawmakers seek to transform what has been an ongoing annual proviso into a law that doesn’t need to be renewed every year.

Since the 2013, state lawmakers have included a proviso in the state budget that enabled tax credits for a scholarship fund and tuition assistance for students to attend private schools that can better suit their special needs. In 2018, this voucher program, which is known as Exceptional SC, has served nearly 2,000 students.

School-choice advocates, including the program’s nonprofit director, say codifying the program doesn’t necessarily mean more state voucher programs are on the horizon. But South Carolina Education Association President Bernadette Hampton said it “definitely opens the door to expanding voucher programs across the state.” SCEA opposes voucher programs that use public dollars as scholarships for private schools because they say the practice drains money away from public education.

‘A life saver’

For Traci Weldie of Simpsonville, Exceptional SC has been “a life saver” for her son George, 16 and her family. George has attended Hidden Treasure Christian School in Taylors for three years. The Exceptional SC scholarship pays for about 30 percent of his tuition fees, and Weldie said they still need to look to friends and family to afford his tuition.

“George has a hope now that he will be able to get a job someday and he will be able to with some assistance live on his own and it’s all because of going to this particular school,” Weldie said.

She said every year as the state legislature finalizes the budget, her family is nervous the program may not continue or may not reauthorize George’s school.

“We want to be able to commit to the school and to George that this is where he will be for the next several years. Every year about this time, our family is under a tremendous amount of stress figuring out how we are going to send him to that school again,” she said. “I’m very encouraged that this is something that would be made into law … Making this into a permanent law would only benefit everyone.”

Weldie also said the increase in the state’s cap on tax credits, from $10 million to $12 million, would help more students like her son.

‘Legislators get it’

The bill was approved unanimously Feb. 16 in the S.C. House. On Wednesday, the Senate Finance Committee gave unanimous approval to send the bill to the floor. The bill now is on the Senate consent calendar, meaning there is no one opposed to the bill, blocking it from a vote.

In conjunction with the state, Exceptional SC offers state tax credits for donations or tuition. For example, if a person donates $100 to the scholarship fund, then he or she will receive $100 off of whatever is owed in state taxes, though the person cannot be reimbursed for more than they owe. The tax credit is currently capped at $10 million. The House extended the credit to $11 million, but the Senate amended to extend it to $12 million. The program also allows parents to receive tax credits for tuition paid if they do not receive an Exceptional SC scholarship. That credit is capped at $2 million in the current budget year and in the proposed bill.

In conjunction with the state, Exceptional SC offers state tax credits for donations or tuition. For example, if a person donates $100 to the scholarship fund, then he or she will receive $100 off of whatever is owed in state taxes, though the person cannot be reimbursed for more than they owe. The tax credit is currently capped at $10 million. The House extended the credit to $11 million, but the Senate amended to extend it to $12 million. The program also allows parents to receive tax credits for tuition paid if they do not receive an Exceptional SC scholarship. That credit is capped at $2 million in the current budget year and in the proposed bill.

Longtime school-choice advocate and former S.C. Republican Party leader Chad Connelly took the helm of the nonprofit last fall. He called the codification “a bipartisan issue.”

“Senators and House members realize special-needs kids need a special education that fits their learning style,” Connelly said. “We’ve had a misty-eye kind of feeling going through these committees and hearing lawmakers speak so highly of the program … A lot of the legislators get it.”

‘Make this thing permanent’

During a Feb. 7 House Ways and Means Committee meeting, Chairman Brian White, R-Anderson, said funding the tax credit by proviso creates uncertainty among parents and guardians whose children benefit from attending private schools.

“It’s time to make this thing permanent,” White said. “You can’t just disrupt them.”

During the Senate Finance Committee meeting this week, Sen. Vincent Sheheen, D-Kershaw, spoke in favor of the program. Sheheen worked with Republican Sen. Larry Grooms, R-Berkeley, to further amend the House’s version to create more accountability.

“There is some good going on in this program and we need to make sure it’s accountable like any other program,” Sheheen said.

S.C. Senate Minority Leader Nikki Setzler, D-Lexington, praised the bipartisan work.

“They worked across party lines for something that works for the state,” Setzler said in the Finance Committee meeting.

More accountability

The S.C. Department of Revenue provides oversight on the program. The agency works with Exceptional SC on record-keeping and disbursing grants. It also oversees tax credits for donors and implements the process for parents to receive tuition tax credits.

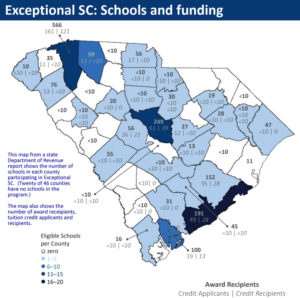

Students awarded a scholarship must attend a school that the Education Oversight Committee (EOC) has approved for program participation. There are 114 schools approved in the state. [This report highlights the schools and amount of money they receive.]

Under the current method of funding, guardians and schools have been left on edge every year to know whether their school will remain in the program, EOC Executive Director Melanie Barton said. With codification, schools will be approved in March every year, instead of May or June.

“It’s been very chaotic for the schools and the EOC … This will give the public the info they need earlier in the year,” Barton said.

Barton said that under codification, the state will also begin to assess individual student performance, something that is not done currently. Private schools do not use state testing and can only provide national tests that aggregate results, Barton said. Once the bill has passed, the EOC will work to show individual gains under the program, looking to states like Florida, which has offered a school-choice voucher for special-needs children since 1999.

Slippery slope: More vouchers on the horizon?

In addition to vouchers for special-needs children, Florida also offers vouchers for low-income students to attend private schools. It’s Florida’s example that has advocates like Hampton worried.

“We have a responsibility to provide great public schools for each student in South Carolina so they have every opportunity to succeed. Vouchers do the opposite and hurt our students, in particular those with special needs, by taking already scarce funding from public schools and giving it to unaccountable private schools,” Hampton said. “Ultimately, we should focus on investing in public schools, where 93 percent of South Carolina’s children go.”

Ashley Landess, executive director of S.C. Policy Council, a conservative think tank, said that while the credit is a good start and benefits many families in the state, it doesn’t go far enough and said she wants to see expanded vouchers in the state.

“This is a very limited tax credit, possibly the most limited tax credit the legislature has ever done,” she said. “Is that fair? Is it fair for some children to have choice and others don’t?”

While Connelly said he’s “always been really involved in dollars following the kid,” he didn’t think codifying South Carolina’s voucher program signals a warming to expanded voucher education programs in the state.

“This is not the same lane, honestly,” Connelly said. “This is so specialized and nuanced; it stands alone.”

- Have a comment? Send to: feedback@statehousereport.com

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!