NEWS: GOP lays groundwork for massive tax changes in S.C.

NEWS: GOP lays groundwork for massive tax changes in S.C.

BRIEFS: All-female Senate panel convenes, crossover, education stalls

COMMENTARY, Brack: Yes, senator, the ox is in the ditch still

NOW AVAILABLE: Brack’s new book highlights how S.C. can do better

SPOTLIGHT: AT&T

MY TURN, Bruce: Lawmakers should pass ethics bills ASAP

FEEDBACK: Two letters on Santee Cooper

MYSTERY PHOTO: What is this photo all about?

S.C. ENCYCLOPEDIA: Battle of Cowpens was turning point in Revolutionary War

NEWS: GOP lays groundwork for massive tax changes in S.C.

By Lindsay Street, Statehouse correspondent | A quiet but “committed” push toward extensive tax reform in the state is underway with GOP leaders hoping to pass changes by the end of the 2020 legislative session. Democrats are more skeptical.

The House Tax Policy Review Committee has worked for years on the question of how to reform the state’s tax woes. Two weeks ago, the first bill to come out of that committee was introduced by committee Chair and House Speaker Pro Tempore Tommy Pope, R-York. It seeks to tax all income-tax payers at a single 4.5 percent rate by slimming credits, deductions and exemptions to the standard deduction, personal exemption and dependent exemption.

A second bill, which calls for removal of most sales tax exemptions and lowering the tax rate, is expected to drop next week. That bill is still being worked on, but it is expected to remove most, if not all, sales tax exemptions. Because the crossover deadline has passed, neither are likely to be taken up this year.

And third, a property tax reform bill is looming for 2020, but Pope and others say they are waiting to see what happens with education reform.

“We’re in a good environment,” Pope told Statehouse Report. “We’ve got a pro-tax reform governor; we’ve got the Chamber of Commerce that’s supportive; the Speaker has always been supportive; we have a leader in Ways and Means that’s supportive; and the Senate is supportive.”

Everyone seems “more committed to addressing tax reform than I’ve seen the entire time I’ve been in the legislature,” Pope said, adding he has worked on tax reform efforts since after his election to office in 2010. He called interest now “the best it’s ever been.”

For months, senators also reviewed problems with the state tax code, which includes income, sales, and property taxes, and user fees, such as the gas tax.

“2020 will be year of the solution,” Summerville Republican Sen. Sean Bennett said Friday. “We have a very unfair tax system, a very narrow-base tax system because we have all these carve-outs and we have a system that is … not a modern system for the economy today and everybody recognizes that and sees that.”

The push has largely come from Republicans. House Minority Leader Todd Rutherford called the renewed reform effort more of “Republican hopefulness” than actually something with legs.

“I don’t think the common body can reach agreement on what we should do,” Rutherford said Friday. “Every time we get ready to do something, lobbyists get involved and we end up back where we were … (I’d be) shocked if we could do anything on a grand scale.”

Broader, fairer, flatter

The mantra among House members has been “broader, fairer, flatter,” and the legislation coming out from committee members reflects that.

Pope’s income tax bill, H. 4334, would tax all income at 4.5 percent. Currently, federally taxable income (income after federal deductions are removed) in South Carolina is taxed between 3 and 7 percent with the top bracket for all income more than $14,860.

The House sales tax reform bill is expected to remove many of the exemptions that have added up over the years.

Much of what the House ad hoc committee has focused on this roadmap for the state by the Tax Foundation, which was produced for the S.C. Chamber of Commerce late last year. Both the House committee and the Senate Finance subcommittee have heard presentations from Washington, D.C., think tank, which typically opposes tax increases, taxes on business and tax credits. Under a recommended option that seeks a 4.75 percent flat tax for all income in South Carolina, the foundation also recommends gradually phasing the school operating costs millage back onto owner-occupied residential property, fully repealing corporate income tax; and removing sales tax exemptions for items such as motor fuel, pharmaceuticals, and unprepared foods.

Proponents of such plans say removing most — or, in some cases, all — exemptions and deductions in income and sales tax helps distribute the tax burden across all categories of people. Bennett said that small businesses and single-parent households are hit hardest by the state’s tax code. He said large businesses, such as Volvo or Boeing, can qualify for tax incentives to avoid getting hit hard by property taxes, and married households get a large deduction not available to single parents. He added that single parents are more likely to pick up prepared meals, which are subject to taxes unlike groceries.

But the more liberal-leaning Institute of Taxation and Economic Policy says such moves would only lead to making an unfair system already unfair. The ITEP currently ranks South Carolina as 39th for tax unfairness (with No. 1 being the least fair), but research director Carl Davis said the “broader, fairer, flatter” argument with taxes will likely hit lower-income earners and the state revenues, which would see a broadening of a base that has experienced wage stagnation.

“South Carolina already is in a situation where higher-income families are paying a lower tax rate than anybody else, and this will only exacerbate the problem,” Davis said.

He called sales taxes “inherently regressive,” and said exemptions help to make it more fair for those who are spending nearly their full paycheck on expenses.

Removing exemptions on sales and income tax tends to draw political fire, too. And that may be the toughest sell for tax reform since 2020 will be an election year for both the House and Senate.

‘The political will’

Every two years, House members face reelection, making it almost a fact of life in the Blatt building. But in the Gressette building, half the members face reelection every four years. That means 2020 could be a year of shying from political risk in the Upper Chamber.

“The question becomes are you able to do something this big and this transformative and this different in an election year, and I’ve been there long enough to know you never say never, but I’ve also been there long enough to know that’s a pretty heavy lift,” Bennett said.

Exemptions have been added to the S.C. tax code piecemeal over the decades, and many of them have strong lobbyists behind them.

“We’ve got all kinds of groups out there that do a pretty good job of manipulating the facts to suit their own mission and will probably do a great deal of work to take a small carve-out and play it out as the worst thing ever,” Bennett said.

Pope said the House will not be immune to the complaints.

“You’re going to hear complaints from whoever has been receiving the carve out,” Pope said. “Whatever benefit somebody is getting, somebody else is carrying the burden.”

And House Democrats say they are ready to take on “flatter” taxes.

“We’re looking forward to making some tweaks but the tweaks need to be in the right direction,” Rutherford said. “Those people that have more [money], pay more … Anything that does not accomplish that objective is a waste of time.”

Some are already questioning whether the tax reform effort should be done bill-by-bill versus comprehensive reform.

Pope said the push will be done in stages, with separate bills for income tax, sales tax and, eventually, property tax.

But Tax Policy Review Committee member Rep. Mandy Powers Norrell, D-Lancaster, disagreed. She said to keep tax policy reform revenue-neutral and to help taxpayers not see an undue burden, it should be included in one large package.

Bennett said the Senate will likely package the tax bills.

“The second we start monkeying with a single piece of the tax code we further weaken the other pieces,” Bennett said. “We have had decades and decades worth of piecemeal tax policy changes.”

- Have a comment? Send to: feedback@statehousereport.com

NEWS BRIEFS

All-female Senate panel convenes, crossover, education stalls

By Lindsay Street, Statehouse correspondent | Something bizarre happened Thursday in room 307 of the Gressette building:

When a Senate Judiciary subcommittee convened, there were no men sitting among the lawmakers or staff present.

At the Statehouse, it is common for all-male panels to review legislation. Only 15.9 percent of lawmakers in Columbia are female and they can only serve on so many committees and subcommittees. South Carolina ranks in the bottom 10 in female representation in its legislature.

The subcommittee was chaired by Sen. Margie Bright Matthews, D-Colleton.

The subcommittee was chaired by Sen. Margie Bright Matthews, D-Colleton. Subcommittee Chair Sen. Katrina Shealy, R-Lexington, also served on the panel and posted a picture of the historic panel on Twitter with the caption: “First in SC History – All Female Senate Sub-Committee and Staff! 3 Bills 2 Regulations – Done on time and in record time. #WomenRock”

“Before there would not have been enough women to have a subcommittee meeting,” Shealy told Statehouse Report. When Shealy was first elected in 2012, she was the only woman serving in the body. In 2018, that number grew to four.

Shealy — who was once called “a lesser cut of meat” by a fellow lawmaker — caught some flack on social media about her focus on gender.

“You want to talk about gender bias, we’ll talk about Finance Committee,” Shealy said Friday. There are no female senators serving on the powerful committee.

The Thursday panel reviewed H. 3973, a House-passed bill seeking to outlaw female genital mutilation. The panel also reviewed H. 3601 and its companion S. 610 (Conditional Discharge of Disorderly Conduct).

In other news:

![]() Crossover deals blow to some bills. Certain contentious bills probably will have to wait until 2020, the second year of the legislative session, after the “crossover” deadline passed this week. It requires bills receive a two-thirds majority to make it to the other chamber. Some of the bills that likely will have to wait until 2020 include:

Crossover deals blow to some bills. Certain contentious bills probably will have to wait until 2020, the second year of the legislative session, after the “crossover” deadline passed this week. It requires bills receive a two-thirds majority to make it to the other chamber. Some of the bills that likely will have to wait until 2020 include:

- Approval of medical marijuana,

- A statewide ban on single-use plastic bags,

- Whether the state should support or oppose offshore drilling,

- Closing the Charleston gun loophole, and

- Allowing open carrying of guns in the state.

- Here’s a list of some of the things that made the crossover deadline.

- Here’s a list of things that didn’t.

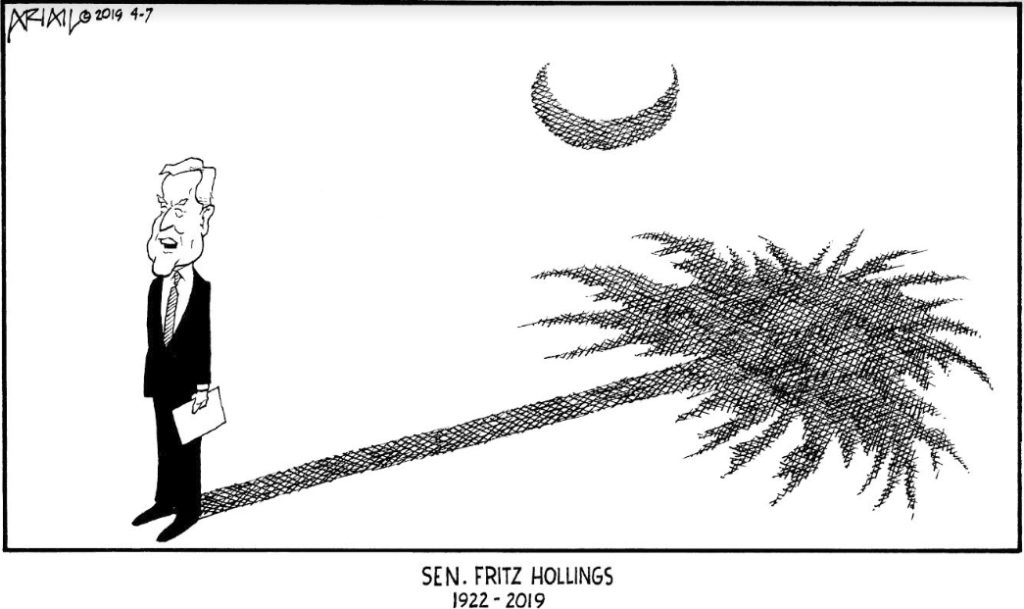

House on break next week. Members of the S.C. House are on break in the coming week, and the Senate will not convene until Wednesday. The body of former S.C. Gov. and U.S. Sen. Fritz Hollings will lie in state at the Capitol Monday, followed by a Tuesday funeral in Charleston. That could push Senate’s debate of the budget into Good Friday, according to S.C. Sen. Katrina Shealy, R-Lexington.

Gubernatorial nominees. Gov. Henry McMaster this week nominated labor attorney G. Daniel Ellzey to be the next director of the S.C. Department of Employment and Workforce. His nominee to lead S.C. Department of Social Services, Michael Leach, got the green light from a Senate panel this week. The Senate is expected to take up Leach’s confirmation as early as next week.

Local government fund restructuring. Lawmakers who have long been fingered for curbing state contributions to local government revenues are poised to restructuring the money doled out to local governments for state mandates. House bill 3137 will reformulate how the state funds local governments and tie that funding to a percentage of state revenues. The bill has advanced to the Senate floor for debate.

Abortion update. Nearly 60 House members pushed for debate on the fetal heartbeat abortion ban bill, House bill 3020, but the bill was not taken up for a vote this week. Meanwhile, a similar bill was passed into law in Ohio this week, making it become the sixth state to eliminate abortion procedures just six weeks after conception.

Weekly update on Palmetto Priorities

Throughout the legislative session, we’ll provide you relevant updates related to our list of Palmetto Priorities, which are 10 big policy areas where major progress is needed for South Carolina to escape the bottom of lots of lists. Over the last week:

Throughout the legislative session, we’ll provide you relevant updates related to our list of Palmetto Priorities, which are 10 big policy areas where major progress is needed for South Carolina to escape the bottom of lots of lists. Over the last week:

EDUCATION: Parts of reform may wait until 2020. Senate Education Committee Chair Greg Hembree, R-Horry, told reporters this week that time is running out and contentious portions of the massive education overhaul bill will have to wait until 2020. Hembree said teacher pay raises, a daily duty-free break and eliminating some state tests will be among the reforms to make a floor vote in the Senate. The Senate Education Committee held 15 meetings to review the House legislation and accept public feedback. House Speaker Jay Lucas issued a statement to Statehouse Report on stalled portions of the bill: “This is the year to bring meaningful education reform to South Carolina. Trying to kill the bill under the guise of deliberative review is unacceptable.”

ENVIRONMENT: Solar bill advances to floor of Senate. The House-passed bill that removes a cap on solar rooftop generation has advanced to the Senate floor. The bill, H. 3659, is still drawing debate, specifically over a 10-year contract rule between utilities and independent solar generators. Read our previous coverage on what’s hanging up the bill.

Looking ahead

Click below for other items coming up in the Statehouse:

- House calendar

- Senate calendar

- Have a comment? Send to: feedback@statehousereport.com

BRACK: Yes, senator, the ox is in the ditch still

By Andy Brack, editor and publisher | “The ox is in the ditch.”

That’s an adage frequently offered by Fritz Hollings, South Carolina’s larger-than-life former governor and United States senator who passed away April 6 at age 97.

But what did it mean? Meet the Press host Tim Russert once asked Hollings with a twinkle in his eye.

But what did it mean? Meet the Press host Tim Russert once asked Hollings with a twinkle in his eye.

Hollings, who often used colloquial sayings to make a point, explained that when an ox hauling a wagon went into a ditch in the olden days, it took more than the ox to pull the wagon out of the ditch. It took several people working as a team to make things right.

So when Hollings, who retired in 2005 after a 38-year Senate career, talked about oxen and ditches and national budgetary, trade or jobs problems, he was saying the country needed to pull together and work as a team to get us out of a particular ditch.

And these days, we’re in a big national ditch, particularly with an untruthful president leading the country away from core values in ways no other president – Republican or Democratic –would have ever imagined. Truth, justice and the American way have been replaced by lies, recklessness and partisan tribalism. Foundational principles, such as the rule of law, seem to have been thrown out the window. The good of the country seems to have been replaced by the greed of a few.

And that’s why today’s leaders need to emulate independent, maverick and sometimes cantankerous voices like Fritz Hollings.

As a former Hollings staffer, my days since the senator’s death have been filled with lots of phone, text and email messages from longtime readers, colleagues and friends expressing condolences. And while I’m sad he is gone, I’ve suggested that people across the state and nation should celebrate his life of accomplishments.

By any measure, Hollings accomplished more in one lifetime than six normal people. As governor, he created the technical education system that provided better job opportunities and wages to hundreds of thousands of South Carolinians. He balanced the state’s budget, earning the AAA credit rating – something leaders have maintained for almost 60 years. He started SCETV, which brings education into people’s homes.

On the national level, he impacted millions of Americans. Untold numbers of mothers and children received food through the WIC program that started after his groundbreaking book, The Case Against Hunger. More than 27 million Americans today receive primary medical care in community health centers through the Health Resources & Services Administration, an $11 billion agency that he helped bring into existence. (The first two centers were in Beaufort County and Massachusetts.)

And those accomplishments were just in his first few years in the Senate. He was the father of critical environmental protection measures, trade bills, budget freezes and commerce legislation that unlocked a telecommunications revolution. The list goes on and on. (See more at FritzHollings.com.)

Hollings spent a career in public service doing the public good. He constantly strived for new ideas and better ways of doing things to fix problems created by others. He challenged colleagues to push for a better America.

And on a personal level, he was about as good of a friend as you could have. One Charlestonian recently recalled that he ran into the senator at an airport and admired his cufflinks. Hollings took them off and gave them to the man. That’s the kind of guy he was.

Fritz Hollings defined the very qualities that Americans are hungry for today – leaders who speak their minds and care about what the people need, not what big business, rich people and insiders want. They want someone who calls ‘em like they see ‘em. They want people who care more for the country than tribal sycophants looking to get past the next news cycle.

Yes, senator, the ox is still in the ditch. More than ever, we need people like you to speak their minds and lead. Thank goodness, you’ve shown us the way to move forward.

Ernest Frederick Hollings. Rest in peace.

Andy Brack served as the senator’s press secretary from 1992 to 1996. Have a comment? Send to: feedback@statehousereport.com.

Brack’s new book highlights how S.C. can do better

Statehouse Report editor and publisher Andy Brack has a new book of selected columns since 2014 that delve into how South Carolina can do better to help people through politics and the governing process.

We Can Do Better, South Carolina! offers incisive commentaries on the American South, the common good and interesting South Carolina leaders, such as former U.S. Sen. Fritz Hollings, civil rights advocate Septima Clark, former S.C. Gov. David Beasley and more. There also are discussions on civil rights struggles with which the Palmetto State continues to grapple. as well as commentaries on politics, governments, the hangovers of South Carolina’s past and her future opportunities.

We Can Do Better, South Carolina! offers incisive commentaries on the American South, the common good and interesting South Carolina leaders, such as former U.S. Sen. Fritz Hollings, civil rights advocate Septima Clark, former S.C. Gov. David Beasley and more. There also are discussions on civil rights struggles with which the Palmetto State continues to grapple. as well as commentaries on politics, governments, the hangovers of South Carolina’s past and her future opportunities.

The 227-page book ends with a discussion of Palmetto Priorities — columns related to Statehouse Report’s continuing push for state lawmakers to adopt a broad agenda for reform throughout government. Included are discussions on education, tax reform, environmental justice and more.

We Can Do Better, South Carolina! is available exclusively as a Kindle book for $7.99. Click here to purchase a Kindle copy. A paperback version will be ready for order in the next week.

- If you have a comment or questions about the book, please let us know at: feedback@statehousereport.com.

SPOTLIGHT: AT&T

The public spiritedness of our underwriters allows us to bring Statehouse Report to you at no cost. Today’s featured underwriter is AT&T Inc.

The public spiritedness of our underwriters allows us to bring Statehouse Report to you at no cost. Today’s featured underwriter is AT&T Inc.

AT&T Inc. (NYSE:T) helps millions around the globe connect with leading entertainment, mobile, high speed Internet and voice services. We’re the world’s largest provider of pay TV. We have TV customers in the U.S. and 11 Latin American countries. We offer the best global coverage of any U.S. wireless provider*. And we help businesses worldwide serve their customers better with our mobility and highly secure cloud solutions.

- Additional information about AT&T products and services is available at http://about.com.

- Follow our news on Twitter at @ATT, on Facebook at http://www.facebook.com/attand YouTube at http://www.youtube.com/att.

BRUCE: Lawmakers should pass ethics bills ASAP

By Catherine Fleming Bruce, special to Statehouse Report | After a flurry of Twitter activity earlier this week on the issue of neglected general ethics bills, both were placed on the Constitutional Laws Subcommittee agenda and were passed on Thursday to the full House Judiciary Committee. House Bill 3045, sponsored by Democratic state Rep. Mandy Powers Norrell of Lancaster, focused on independent expenditures, and House Bill 4203, sponsored by GOP state Rep. Gary Clary of Clemson, attended to campaign practices.

With only the League of Women Voters of South Carolina’s vice president, Lynn Teague, and me speaking in favor, we were outnumbered by opponents funded by the Koch Brothers and other corporate giants. Yet somehow, the two bills managed to prevail.

In my remarks, I set out to remind committee members of the effort put in by the State Grand Jury through its two years of convening and its unusual issuance of a report not only to hear the cases of individual legislators, but to push our state toward improvement of its ethics laws and rules in order to better protect the public interest, rather than the special interests.

I strongly support H. 3045 and its clear mandate for strengthening of disclosure procedures for independent expenditure committees and clarification of campaign practices in conformity with federal rulings. The State Grand Jury report specifically states that enacting bills such as these two will remove “dark money” from our elections and legislative decision-making.

Likewise, I support H. 4203 for its clarification of contributions, noncandidate committees and ballot measure committees.

It was heartening to see that bills have been submitted by members of the 2019 legislature from both sides of the aisle – indicating their understanding that this issue is critical to the entire S.C. populace.

In sharp contrast to the matters in this subcommittee, my quick visit to the Statehouse at the meeting’s conclusion found the lobby packed with Carolina Panthers’ supporters and lobbyists, working to convince legislators to approve Senate Bill 655, a tax break package to bring the team to our state. S.C. Sen. Dick Harpootlian’s objection stops the bill from advancing to debate or vote as his analysis has not demonstrated support for the economic impact numbers provided. Meanwhile, other news outlets have reported that Gov. Henry McMaster received a campaign contribution from Panthers owner David Tepper.

Is there still a chance for the “sunshine” bills to become law in this legislative session? Some say the window is closed, though the bills could advance next legislative session in time to stop dark money spending in South Carolina during the 2020 presidential elections. Others suggest that with a supermajority vote, the bills could still be passed in our current session and be signed by the governor before the gavel falls for the year.

This week, McMaster ordered the flag atop the Statehouse flown at half-staff this week in honor of U.S. Sen. Ernest ‘Fritz’ Hollings, who passed on April 6 at age 97. On Monday and Tuesday, the state and its citizens will mark the memory and legacy of Senator Hollings, who called money “a cancer on the body politic.”

Therefore, it is only fitting that this week, the South Carolina House Constitutional Law subcommittee took the first steps to lower the flags of public corruption and dark money that flutter atop our Statehouse by approving passage of these two bills. We encourage the House and Senate to put these bills over the finish line for the governor’s signature before the close of this legislative session, perhaps with the addition of stiffer sentences for legislators who violate the laws, a move also recommended in the State Grand Jury report.

Teague described the dark money bills as “one of the most important issues to come before the General Assembly.” For this reason, let us see a rally at the Statehouse for this good cause. It should be as easy as 1-2-3.

Catherine Fleming Bruce, a Columbia-based award-winning author and activist, served as lead for Black Voters Matter and March On the Polls activities in 2018. She currently leads Tnovsa Global Commons, which focused on good governance, ethics, and preservation projects.

- Have a comment? Send to: feedback@statehousereport.com..

FEEDBACK

Two say Santee Cooper doesn’t need to be sold

To the editor:

![]() Thanks for a good article in Saturday’s Florence Morning News. Seems to me that there are many good reasons not to sell Santee Cooper. You dealt well with the important ones.

Thanks for a good article in Saturday’s Florence Morning News. Seems to me that there are many good reasons not to sell Santee Cooper. You dealt well with the important ones.

Some of the lesser reasons that have gotten little discussion are:

a) The value of the water in the lakes to all of South Carolina. it may not be long before a supply of fresh water may be as valuable as electricity.

b) The fact that the land for Santee Cooper was acquired by the state by eminent domain, without much objection, because it was so important to the United States’ war effort. if that land is to be sold to a private company, [it] seems to me the original owners should be paid somehow for the value of what they sacrificed involuntarily.

c) Surely there are enough able people loyal enough to their fellow citizens of South Carolina to run a small hydroelectric generator with fairness and efficiency. The selfishness that has been revealed within the SCANA and Santee Cooper organizations surely is not a prerequisite for management of a successful South Carolina electric utility.

— Ben Williamson, Darlington, S.C.

To the editor:

At least you are one of the people around the Statehouse that see the real importance of looking at all options and may be willing to try a management recycling program.

I would hate to see this valuable asset to the state, sold on a whim. Thanks for an objective article and not a paid advertisement.

— Robert Jeffcoat, Moncks Corner, S.C.

Send us your thoughts … or rants

We love hearing from our readers and encourage you to share your opinions. But you’ve got to provide us with contact information so we can verify your letters. Letters to the editor are published weekly. We reserve the right to edit for length and clarity. Comments are limited to 250 words or less. Please include your name and contact information.

- Send your letters or comments to: feedback@statehousereport.com

MYSTERY PHOTO: What is this photo all about?

Here’s a photo older than Statehouse Report’s editor, but what is it and why are all of these folks smiling? Send your guess about the location of this photo to feedback@statehousereport.com. And don’t forget to include your name and the town in which you live.

Our previous Mystery Photo

Our April 5 mystery, “More than a farm field” showed what Cowpens National Battlefield Park looks like these days. The Revolutionary War battlefield is just east of Chesnee in the Upstate. More below on why it was critical to the patriots.

Our April 5 mystery, “More than a farm field” showed what Cowpens National Battlefield Park looks like these days. The Revolutionary War battlefield is just east of Chesnee in the Upstate. More below on why it was critical to the patriots.

Congrats to these history sleuths: Charles Davis of Aiken; David Taylor of Darlington; Barry Wingard of Florence; Frank Bouknight of Summerville; Dale Rhodes of Richmond, Va.; and Val Valenta and Jay Altman, both of Columbia and both of whom provided context.

Valenta shared why the battle was important: “The Battle of Cowpens was a Revolutionary War battle fought on January 17, 1781, between American Colonial forces under Brigadier General Daniel Morgan and British forces under Lieutenant Colonel Sir Banastre Tarleton, as part of the campaign in the Carolinas. The battle was a turning point in the American reconquest of South Carolina from the British. Tarleton’s British brigade was wiped out as an effective fighting force, and, coupled with the British defeat three months earlier at King’s Mountain on October 7, 1780, British General Charles Cornwallis was compelled to pursue the main southern American army into North Carolina, leading to the Battle of Guilford Court House, and Cornwallis’s eventual defeat at the Siege of Yorktown in October 1781.”

Altman shared similar detail but added, “Maybe my grandmother’s insistence that I be a member of the Children of the American Revolution in Mullins, S.C., some 50 plus years ago helped me with this!”

Send us a mystery: If you have a photo that you believe will stump readers, send it along (but make sure to tell us what it is because it may stump us too!) Send to: feedback@statehousereport.com and mark it as a photo submission. Thanks.

S.C. ENCYCLOPEDIA

HISTORY: Battle of Cowpens was turning point in Revolutionary War

S.C. Encyclopedia | In mid-December 1780 General Daniel Morgan positioned his “Flying Army” on the Pacolet River to threaten the British stronghold of Ninety Six. British general Lord Cornwallis responded by dispatching Lieutenant Colonel Banastre Tarleton to protect Ninety Six and drive Morgan from South Carolina. Learning that Ninety Six was safe, Tarleton moved against Morgan with 1,250 men.

Morgan withdrew and assembled his force on January 16, 1781, at Hannah’s Cowpens, a well-known local site situated near the North Carolina border in present-day Cherokee County. When the British reached the battlefield about daybreak on January 17, Morgan, reinforced by militia to about two thousand men, was ready to fight. He deployed more than three hundred North Carolina, South Carolina, and Georgia riflemen skirmishers, which forced Tarleton to deploy. Behind these skirmishers, Colonel Andrew Pickens led one thousand militiamen from the South Carolina upcountry, placing them on the reverse slope and hiding many from British scouts. A third line of Delaware, Maryland, and Virginia Continentals, Virginia State Troops, and militia was to their rear, arranged so as to allow a militia withdrawal without disrupting their ranks. Continental cavalry and militia waited for an opportunity to strike.

British infantry advanced and drove back the skirmishers. Other British infantry deployed and went forward, their flanks covered by dragoons. When the British closed within thirty yards, militia fired at least five battalion volleys. Despite losses, the British charged with bayonets, routing the militia. From this point three separate lines of advance occurred. The British infantry reformed and moved within thirty yards of the Continentals, engaging them in a firefight, and British dragoons advanced on both flanks. On the American left, British dragoons scattered reforming militia. The British, in turn, were repulsed by William Washington’s cavalry. On the American right, British Legion dragoons and the Seventy-first Scottish Highlanders advanced, driving off North Carolina skirmishers and then taking position beyond the American right flank. These British dragoons also were repulsed by Washington’s cavalry, who charged through them, turned, and charged back.

Outflanked, the American third line commander, John Eager Howard, ordered a right company to turn and oppose the Highlanders. For several reasons the maneuver failed, and a withdrawal commenced with the Highlanders in hot pursuit. One hundred yards upfield, the Americans, who reloaded as they withdrew, turned and fired, so shocking the Highlanders that many collapsed while others ran. They were pursued by American infantry and dragoons who swept the battlefield. Tarleton’s infantrymen were virtually all captured, but most British dragoons escaped. Total British casualties were about 800. American casualties were approximately 25 killed and 124 wounded.

The Battle of Cowpens was a turning point in the Revolutionary War. To recapture the prisoners, Cornwallis lightened his army and pursued Morgan and then Greene across North Carolina. This “Race to the Dan” wore out the British. They did win a costly victory at Guilford Courthouse (March 15, 1781), then marched to the coast and on to Virginia, where Cornwallis surrendered to a combined Franco-American army at Yorktown (October 19, 1781). After Guilford Courthouse, Greene returned to South Carolina and defeated British forces in a “War of Posts” during the summer of 1781. Greene’s support of partisans, especially Francis Marion and Andrew Pickens, drove the British to the coast by October 1781, effectively ending British domination of interior South Carolina. See plate 11.

— Excerpted from an entry Lawrence E. Babits. This entry may not have been updated since 2006. To read more about this or 2,000 other entries about South Carolina, check out The South Carolina Encyclopedia, published in 2006 by USC Press. (Information used by permission.)

ABOUT STATEHOUSE REPORT

Statehouse Report, founded in 2001 as a weekly legislative forecast that informs readers about what is going to happen in South Carolina politics and policy, is provided to you at no charge every Friday.

- Editor and publisher: Andy Brack, 843.670.3996

- Statehouse correspondent: Lindsay Street

More

- Mailing address: Send inquiries by mail to: P.O. Box 22261, Charleston, SC 29407

- Subscriptions are free: Click to subscribe.

- We hope you’ll keep receiving the great news and information from Statehouse Report, but if you need to unsubscribe, go to the bottom of the weekly email issue and follow the instructions.

- © 2019, Statehouse Report. All rights reserved.