By Lindsay Street, Statehouse correspondent | A state Democratic lawmaker wants to “supercharge” a new federal tax break aimed at fueling private investment — and subsequently, jobs, housing and business — in blighted areas.

The federal Opportunity Zones tax break has received criticism from national publications and tax policy experts who say it benefits the wealthy and promotes gentrification.

But S.C. Rep. Marvin Pendarvis of North Charleston sees a bright side. That’s because the federal tax break needs a state component to make it successful, he said.

“If what I propose gets introduced and passed, it changes lives tremendously,” said Pendarvis, a Democrat. Half of his district is in an opportunity zone that he said is plagued with drugs, crime, homelessness and hopelessness. “We’re facing some real-life challenges in these zones … We need to make sure the investment has a return for the people as well.”

Pendarvis wants to add a state-level tax break for developers, but with a caveat: There needs to be tangible community benefit — such as jobs, affordable housing or green space — from qualifying projects. He said his bill, which will be prefiled prior to the 2020 session, will also track investments and promote community input to help create transparency and accountability.

Program costs $1.6 billion

The Opportunity Zones program is a tax break established in the Republican-backed 2017 federal tax overhaul. The program received bipartisan backing from U.S. Sens. Cory Booker of New Jersey, a Democrat, and Tim Scott of South Carolina, a Republican. Earlier this year, it was championed by Vice President Mike Pence who praised the program while touring the state’s opportunity zones.

“It’s all about making sure that as the American economy expands, it’s going to expand for every American,” he said.

The program allows developers to use capital gains — profits made from other investments — and re-invest that money into real estate and projects in specified zones, typically identified as low-income. The capital gains-fueled investment then will be untaxed unless the developer withdraws his or her investment before 10 years.

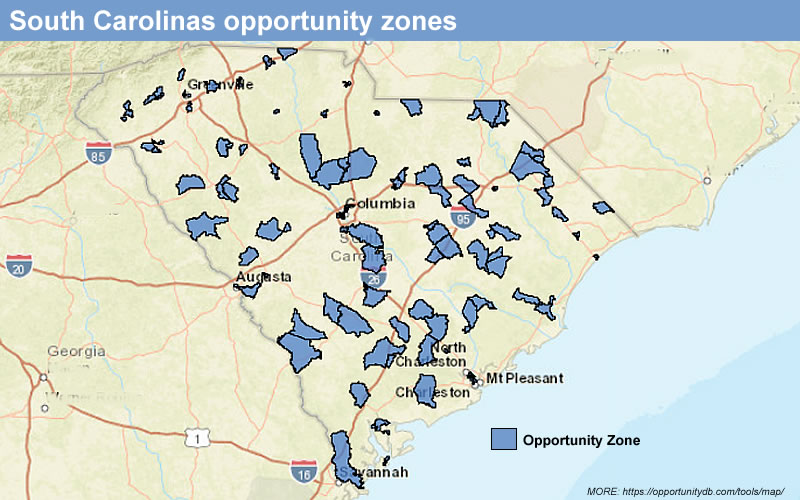

The idea is to spur new housing, businesses and jobs. One estimate says there is $2 trillion in capital gains funding that could be invested into the zones. The Tax Foundation estimated the program would cost $1.6 billion in revenue from 2018 to 2027. There are no estimates on what it could cost state governments, like South Carolina, that have coupled the state tax code with the legislation.

- Want to learn more about the Opportunity Zones program in South Carolina? The S.C. Opportunity Zone Summit is 9 a.m.-4 p.m. Oct. 10 at the Greenville Convention Center. The summit is geared toward stakeholders and investors. U.S. Sen. Tim Scott and industry experts will be at the summit. More info.

City sees ‘accelerating’ revitalization

Rock Hill has one of the state’s 135 designated opportunity zones. In the last year, the city has seen about eight projects totaling $250 million in investment, according to its economic development director.

Many of those projects were already in the works prior to the 2017 tax break, Mayor John P. Gettys told Statehouse Report. But, he added, the program is “accelerating” revitalization.

The city of Orangeburg has seen fewer projects in the pipeline but the presence of an opportunity zone has spurred more interest from developers, Mayor Michael C. Butler said.

“It’s been giving it more visibility,” he said. One project, a barber school, has set up in an abandoned building.

Statehouse Report reached out to nearly a dozen mayors with opportunity zones in their municipalities. Only Gettys and Butler responded.

Other than reaching out to local leaders directly, there is no way to track how many investments, the amount of investment dollars and how many jobs are tied to the federal program.

‘A weird incentive’

The relative newness of the Opportunity Zones program and the lack of centralized data collection on investments has made judging the success of the program problematic, according to tax policy experts.

- A yearlong study of the Opportunity Zones program by The New York Times was released Aug. 30. The analysis relied mostly on anecdotal evidence, and highlighted a number of problems with the federally encouraged investments. The story reported “the Trump administration’s signature plan to lift (America’s poorest areas) — a multibillion-dollar tax break that is supposed to help low-income areas — has fueled a wave of developments financed by and built for the wealthiest Americans.” Read more.

“We may never know how effective this program is. We’re going to be relying on anecdotal information,” Center on Budget and Policy Priority senior fellow Michael Mazerov said. In May, federal lawmakers, including Scott, introduced legislation to require reporting on the investments.

One of the earliest studies of opportunity zones has found a direct increase on property prices for redevelopment properties (up 14 percent) and vacant development sites (up 20 percent). The 2019 paper lines up with the fear that the federal incentive could fuel price increases that make running a business or affording rent in such zones difficult for those already living there.

Palmetto Project Executive Director Steve Skardon said the way the program is written, there is a potential for gentrification.

“It’s going to be average working people who are already struggling that have to turn around and move and find affordable housing somewhere else,” he said.

While opportunity zones are still too new for many tax policy experts to say whether they are successful, there have been a handful of place-based incentives from state and federal governments in the past, including Clinton-era enterprise zones and Obama-era promise zones.

The Tax Foundation’s federal research manager, Scott Eastman, said place-based incentives create “a weird incentive.” Businesses move across the street to get a tax break, so no new jobs are actually created, for example.

Mazerov said such incentives often can’t overcome the “very powerful economic reasons” an area is depressed, and they show little evidence for being “cost effective” for government to lose revenue to promote growth in a blighted area.

Making it work in South Carolina

Pendarvis’ proposal is based off of state-level incentives from Maryland and Alabama that are linked to the Opportunity Zones program.

“They realized that the federal legislation is only the first step,” Pendarvis said. Those states made community benefits a priority.

He is currently looking for support from the Governor’s office and Republican leadership in Columbia, but no Republican has offered to co-sponsored a bill yet, he said.

Skardon said state and local involvement could help the Opportunity Zones program succeed beyond helping investors make more money.

But Mazerov remained skeptical that states should piggyback off the federal program, however.

“Before considering more tax incentives to shape the amount, type, or location of opportunity zone investments, states should see what the existing incentives produce,” he wrote in May. He also suggested states like South Carolina follow North Carolina’s footsteps and “decouple” from the federal tax break so state revenues aren’t affected.

- Have a comment? Send to: feedback@statehousereport.com

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!

Pingback: Charleston Currents – 11/25: On #GivingTuesday, Thanksgiving, more

Pingback: Charleston Currents – GOOD NEWS: 2 Lowcountry lawmakers want to define “consent”