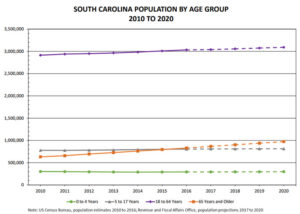

By Lindsay Street, Statehouse correspondent | Sometime in the last year or so, the retiree population began to outnumber school-age children in South Carolina. The burgeoning elder population is following the national trend from aging baby boomers, but the state is also seeing many move here from out-of-state.

And that could lead to a tough conversation on senior tax exemptions and the budget, according to tax experts. This week, S.C. House members unveiled a proposed tax reform that would slash many senior tax exemptions — similar to a 2012 move in Michigan, which sought to flatten its tax code.

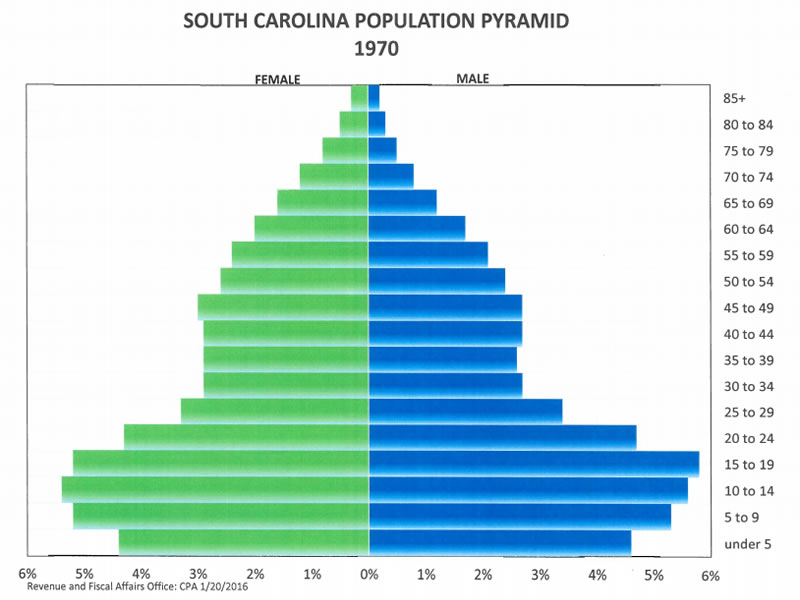

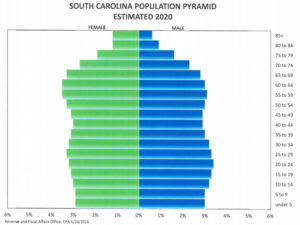

Frank Rainwater, executive director of S.C. Revenue and Fiscal Affairs Office, led a Tuesday budget presentation for the House Ways and Means Committee, and provided an examination of the state’s changing populations. According to the U.S. Census data, a bulk of the population in South Carolina in 1970 was under the age of 20. Now almost 50 years later, a population pyramid from 1970 (see figure) has become more of a population rectangle today (see figure at top of this story), thanks to the state’s aging generation. This is coupled with the state’s declining birth rate, which peaked in 2008.

What this all means for South Carolina is hard to tell, but it’s probably not good, particularly for working class families, if tax burdens shift.

S.C.’s retiree-friendly atmosphere

Attracting and retaining the older population is built into South Carolina’s milieu of tax exemptions. It’s an economic development strategy that other states have employed as well. But that strategy could also lead to deficits, according to John Buhl, a spokesman for the nationally-prominent Tax Foundation.

Attracting and retaining the older population is built into South Carolina’s milieu of tax exemptions. It’s an economic development strategy that other states have employed as well. But that strategy could also lead to deficits, according to John Buhl, a spokesman for the nationally-prominent Tax Foundation.

“It’s a very tough conversation but it’s one that states are going to have to have at some point,” he said, adding that states need to start asking these questions:

- Should the tax code continue to attract wealthy retirees?

- Will their spending make up for their burden on state expenses? and

- Will the state’s revenues find stability in population that is dying off?

In any number of national surveys from SmartAsset to Kiplinger, South Carolina is touted as a good place to retire. The state does not tax Social Security retirement benefits and it offers a $15,000 deduction for seniors receiving any other type of retirement income. Northerners often find cheaper homes, closer to the water, and the state offers a break on already-low property tax rates by exempting $50,000 from taxes. Public and private pensions are partially taxed.

Tax-exemptions and other retiree-friendly offerings from the state are seen partly as aid to lower-income elderly and partly as economic development, according to experts like Rainwater and to officials at the state’s leading retiree advocate, AARP of South Carolina.

“They’re bringing in new-tax bases to the state,” Rainwater said. “They do get exemptions but they’re spending.”

He said it’s not just medical services but also more demand for restaurants and other service industries. Wealthier retirees bring more income and time to the state, AARP’s Patrick Cobb said.

“When they come here not only are they bringing their time, talent and resources, they are bringing their disposable income and that’s huge,” he said. He added the state’s investment in seniors has created a mutually beneficial relationship.

But the good times can’t continue forever, according to Buhl. At some point, seniors will place an increased demand on services that are largely funded by working citizens and any wealth they bring to the state will dwindle as the population slowly dies off.

“Your income tax base is going to start to get smaller,” Buhl said. “People who are working end up picking up a lot more of the tax tab.”

Buhl said Michigan targeted retiree exemptions in 2012, when the state changed the taxable status of retiree income as part of a broader reform package seeking to simplify the tax code. In 2014, the reform was hailed as a “win-win” for businesses and local government.

“Making retiree income subject to tax while lowering tax rates elsewhere can make for a more equitable tax code and offset the impact of taking away a tax break,” Buhl said.

Tax exemption proposals are floating around now

Michigan is typically seen as the exception, not the rule when it comes to tax breaks in seniors, Buhl said.

Michigan is typically seen as the exception, not the rule when it comes to tax breaks in seniors, Buhl said.

“Seniors are a very revered population and, politically, they vote,” Buhl said. “Any state that has looked at trying to scale these back, it’s a very politically difficult decision.”

On Thursday, the S.C. House Tax Policy Review Committee unveiled a tax reform proposal to eliminate some sales tax exemptions in the state in favor of dropping the state sales tax from 6 percent to 3 percent, and eliminating the sliding scale of income tax and some of its exemptions from 3 percent to 7 percent to a flat 4.85 percent income tax

Also targeted in the reform is elimination of the Social Security Income Exemption, the $15,000 of income Age 65 and Over Exemption, the $3,000 Retirement Income Exemption for under Age 65) and the Military Retirement Exemption.

But the income exemption conversation is just getting started. Earlier this year, candidates for governor jockeyed for the limelight from retirees, with incumbent Gov. Henry McMaster and his GOP rival Lt. Gov. Kevin Bryant saying lowering taxes is key to helping retirees. Other Republican hopefuls Catherine Templeton and Yancey McGill floated expanding property tax exemptions on seniors.

McMaster has also said he wants to see law enforcement and military retirees pay zero state income tax.

For years, at least two legislators have pushed additional senior exemptions for property tax. S.C. Sen. Glenn Reese, D-Spartanburg, wants a homestead-like exemption on senior’s vehicles, up to $20,000 worth, and S.C. Rep. Kit Spires, R-Lexington, wants the homestead exemption to be expanded and include 100 percent of a home’s appraised value.

“We all as legislators want to do feel-good stuff and introduce things people like,” Reese said. “But you want a balance because somebody has got to pay a bill.”

Caps on property tax exemptions, like the one in Reese’s bill, is one way states can help lower-income retirees while also attracting and benefitting from wealthier retirees from out-of-state, according to Buhl.

Spires also said his bill could be capped at $100,000 and utilize a residency restriction — all things that can come up in amendments if it ever gets debated. As is, his bill comes with a $100 million price tag as the state would have to pick up more of local school district expenses with the property tax loss.

“That’s the uphill battle I face,” Spires said. “Until our state can generate more money and more revenue, this legislation is not going to pass.”

Both men said the bills aren’t about winning votes, but complying with the wishes of their constituents.

Cobb said the state is already plenty attractive for out-of-state retirees and that the conversation needs to move beyond taxes. He said community programs that help seniors stay connected, obtain transportation and receive meals, and supporting caregivers are key elements to consider in the coming years. His group is also keeping tabs on the state’s soaring electricity rates and expanding nurse practitioners’ roles.

- Have a comment? Send to: brack@statehousereport.com

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!