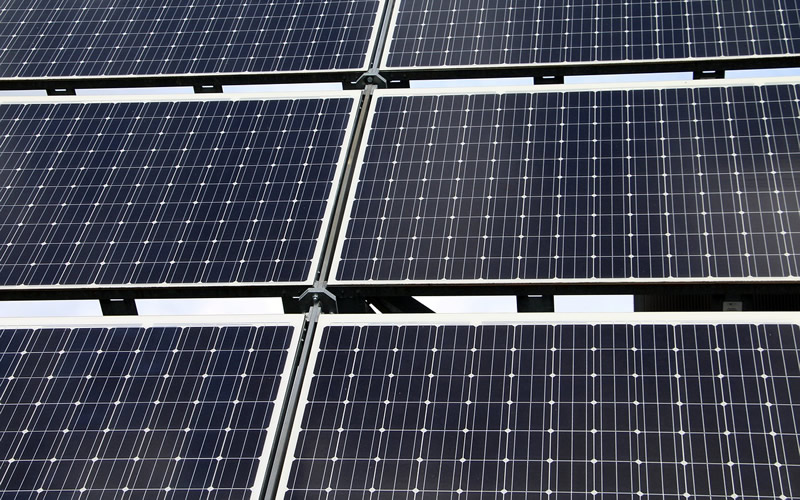

By Lindsay Street, Statehouse correspondent | How South Carolinians will be reimbursed or paid for energy generation from rooftop solar remains unanswered, but lawmakers have advanced a bill that would allow the industry to continue to grow while regulators figure that out.

A compromise in a House subcommittee on the bill, H. 3659, would keep the rooftop solar business going until 2021 as the state Public Service Commission studies how to regulate the industry. Then, the commission would establish rules for solar, including how much homeowners would be paid by utilities for the power that they provide to the electrical grid from their rooftop solar panels.

The proposal, called the “South Carolina Energy Freedom Act,” will now go before the full House Labor, Commerce and Industry Committee. As of deadline for publication, the bill was not yet scheduled for a hearing. The bill’s Senate companion, S. 332, has been referred to the Senate Judiciary Committee and will be heard in subcommittee 12:30 p.m. Feb. 20 in room 105 of the Gressette building. See the agenda here.

In South Carolina, a 2-percent cap on net metering of residential solar generation was implemented by the Legislature in 2014. Net metering comes into play when a residence generates more solar than it is using, and the allows residential solar generators to sell excess energy to a utility in exchange for a credit for energy used.

In recent years, conservationists and solar advocates pushed hard against the cap, asking lawmakers to remove it because it could dampen the industry. Once the cap is reached, utilities don’t have to give full credit for the energy generated by the rooftop solar, lessening the incentive for residences to buy solar panels, advocates say. Duke Energy Carolinas could hit its 2-percent cap next month. Other utilities are expected to follow soon as the popularity of using the alternative energy generation grows.

In other recent news:

![]() Weaver elected chair of EOC. School choice advocate and current CEO of Palmetto Promise Institute Ellen Weaver has been elected chair of the S.C. Education Oversight Committee.

Weaver elected chair of EOC. School choice advocate and current CEO of Palmetto Promise Institute Ellen Weaver has been elected chair of the S.C. Education Oversight Committee.

Senate stalls on Santee Cooper. The State newspaper reported this week that the S.C. Senate is refusing to pay any more to ICF, the Virginia-based consultant studying offers to buy Santee Cooper. The House and Senate already have paid ICF nearly $380,000, and the state has received 15 bids for the public utility. According to an email obtained by The State, the Senate “wants to carefully consider the next steps in this process before committing to expending the large sums that may be necessary.”

Free-range parenting bill. A Senate bill, S. 79, that seeks to allow parents to leave a competent child home alone or allow the child to engage in activities alone will be heard by the full Senate Judiciary Committee 11 a.m. Feb. 19 in room 105 of the Gressette building. See the agenda here.

Weekly update on Palmetto Priorities

Throughout the legislative session, we’ll provide you relevant updates related to our list of Palmetto Priorities, which are 10 big policy areas where major progress is needed for South Carolina to escape the bottom of lots of lists. Over the last week:

Throughout the legislative session, we’ll provide you relevant updates related to our list of Palmetto Priorities, which are 10 big policy areas where major progress is needed for South Carolina to escape the bottom of lots of lists. Over the last week:

HEALTH CARE: Costs rising for S.C. businesses. The S.C. Chamber of Commerce has released a report titled “Strategies to Mitigate the Rising Healthcare Costs” in response to businesses saying “the rising cost of healthcare has been and continues to be one of the most challenging issues facing the business community.” The Chamber Foundation chartered a task force of state business leaders and healthcare policy experts who identified cost mitigation strategies. Here are some of the strategies:

- Conduct a reinsurance study. Businesses can directly address the “risk pool” problem embedded in the Affordable Care Act, according to the report. In this section of the report, the task force recommends South Carolina seek an “innovation waiver” to help reduce premiums and increase enrollment.

- Increase use of online tools. This recommendation seeks more usage of price comparison assessment tools by companies.

- Prepare and promote a “Healthcare Literacy Toolkit.” This recommendation encourages employers to offer clear and informative information about healthcare coverage to employees.

- Consider state tax credits for employer wellness programs. The task force report says employers would be further incentivized to create wellness programs, which can improve the health of their workforce, by the state offering state tax credits for the company. This recommendation does not propose what that credit would look like in South Carolina, but cited a 2012 Kentucky study that weighed the idea there.

HEALTH CARE, PART II: Panel to review expansion of physician assistant role in state. A Senate Medical Affairs subcommittee will look at S. 132 at 10 a.m. Feb. 20 in room 410 of the Gressette building. See the agenda here. Should this bill receive a favorable report, it is slated to be heard by the full committee 10 a.m. Feb. 21 in room 308 of the Gressette building. See the agenda here.

GUN REFORM: S.C. congressmen seek to close “Charleston loophole.” U.S. Reps. James Clyburn and Joe Cunningham, both S.C. Democrats, have filed legislation that would extend background check time for some gun purchases. Read more. The bill was dropped on the anniversary of the Parkland, Fla., high school shooting that left 17 dead. Meanwhile, at the Statehouse, S.C. Rep. Wendy Brawley and others pushed Thursday for two bills to curb gun violence. Those bills include:

- H. 3109 establishes a school safety fund to pay for school resource officers by levying a 7 percent tax on firearm sales; and,

- H. 3240 would ban bump stocks, machine guns, and high capacity magazines.

EDUCATION: Consolidation mulled. Senators in an education subcommittee this week weighed a bill that would consolidate 13 schools districts in the state based on a set of criteria. S. 203 says districts must consolidate if they meet two of the following four criteria:

- Average daily membership less than 1,500;

- An accreditation status of probation or denied;

- A state designation of Fiscal Caution or Warning pursuant to Section 59-20-90; and,

- A risk assessment of medium or high or the district has a school that has been in improvement status for three years

TAXES: Committee continues studying issue. The House ad-hoc tax reform committee is continuing to study this issue. No legislation has been dropped so far, but committee members were briefed by Jared Walczak of the Tax Foundation. Watch the presentation here. A hard look at sales tax exemptions is also underway.

CORRECTIONS: Sentencing reform in House subcommittee. The mammoth H. 3322 sentencing reform bill is back in front of a House subcommittee 9 a.m. Feb. 20 in room 516 of the Blatt building. See the agenda here.

Looking ahead

Click below for other items coming up in the Statehouse:

- House calendar

- Senate calendar

- Have a comment? Send to: feedback@statehousereport.com

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!