By Andy Brack, editor and publisher | South Carolina House members will consider something new next week in the state’s $10 billion budget — a single line item that sets aside $500 million to keep agencies from making midyear cuts that could be brought on by unexpected pandemic expenses.

“That is General Fund money (or money from state taxes) that was set aside as a first line of defense should revenues not continue to remain positive and stable,” said S.C. House Ways and Means Chairman Murrell Smith, R-Sumter.

The state currently has two reserve, or “rainy day,” funds. But rules on those funds restrict spending to balancing the state budget at the end of the fiscal year. In other words, if an agency had a shortfall during the year from something, like say a pandemic, then it would have to make program cuts, lay off workers — or both.

Last fall, Senate and House staffers started discussing ways to give agencies more flexibility in case revenue streams are hit after July 2021 because of economic reactions to the pandemic. They came up with the notion of setting aside $500 million in surplus dollars if things go awry. But if nothing is spent by June 30, 2022, lawmakers can use the money for something else — or keep the reserve intact for other midyear rainy day needs as might come with a hurricane or flood.

Observers say this is smart budgeting because it anticipates challenges with a solution that will improve the stability of the budget so state agencies don’t have ups and downs with staffing and programs.

More money could be available

Smith said the proposed state budget, which will be debated on the House floor starting 1 p.m. Monday, should be considered “very conservative” as there were few increases to general operations of most agencies. But revenues could grow if the state Board of Economic Advisers (BEA) boosts revenue estimates in April from state taxes. A year after the pandemic started, the Palmetto State has an unemployment rate of just over 5 percent, which is just 1 percent off historic lows before the health crisis that kept many people at home for months.

“The majority of the new funds were spent on agency needs and additional reserves,” he told Statehouse Report. “I believe if we continue down the same track we are on now, the BEA will most likely increase the estimate in April.

“The majority of the new funds were spent on agency needs and additional reserves,” he told Statehouse Report. “I believe if we continue down the same track we are on now, the BEA will most likely increase the estimate in April.

“In the event that revenues decline, then we should be able to continue government at the same spending levels without laying off state employees with this budget.”

Smith said he was particularly proud of two things funded in the 2021-22 spending plan.

First is the $50 million set aside to pay for another reserve fund for disaster relief and resilience after lawmakers passed a law last year that created a state Office of Resilience. The new fund will allow the state to pay for disaster assistance, hazard mitigation, infrastructure improvements and resilience planning. A recent budget proposal by Gov. Henry McMaster called for funding the office, but not the reserve.

Second, Smith pointed to $30 million targeted to expanding broadband service, which is particularly important for rural areas of the state for business and education.

General budget overview

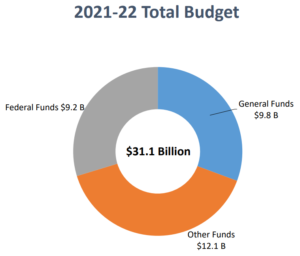

The 2021-22 budget for the state will top $31 billion. Of that, $9.8 billion will come from state taxes, such as taxes on income and sales. Another $9.2 billion will come from federal sources, such as dollars that flow through state agencies for roads, Medicare and Medicaid. And then there’s $12.1 billion in “other funds,” an account that generally includes monies that got to the state that aren’t General Fund dollars — things like college tuition, gas taxes, Education Improvement Act funds and receipts from the state’s education lottery.

The 2021-22 budget for the state will top $31 billion. Of that, $9.8 billion will come from state taxes, such as taxes on income and sales. Another $9.2 billion will come from federal sources, such as dollars that flow through state agencies for roads, Medicare and Medicaid. And then there’s $12.1 billion in “other funds,” an account that generally includes monies that got to the state that aren’t General Fund dollars — things like college tuition, gas taxes, Education Improvement Act funds and receipts from the state’s education lottery.

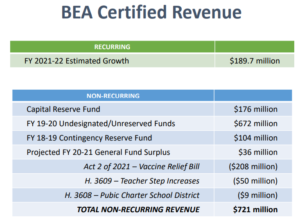

In the next year, lawmakers currently anticipate more than $900 million in new revenues, including $190 million in recurring revenues from the growth in the state’s tax base as well as $721 million in non-recurring, or one-time, revenues stemming from reserves and surpluses.

- Read the briefing that House members got on the budget.

- Read the state budget (all 1,790 lines of it).

Major state general fund spending highlights

Reserves: $500 million for the Pandemic Stabilization Reserve Fund; and $26 million in added funding to the capital and general reserve funds. With this budget, the state’s reserves are $1.1 billion, according to the committee.

Education: $50 million to increase the base student cost to $2,500 per student and a like amount for one-time pay increases to eligible teachers. The Department of Education’s $3.3 billion base share of state dollars includes an additional $48 million in instructional materials, $24.5 million for public charter school growth; and $10 million to expand full-day 4-year-old public kindergarten.

Higher education: Colleges and universities will get $171 million in new money, the lion’s share of which will go to deferred maintenance. The state’s technical college system will get $10 million for maintenance and capital needs as well as $33 million for workforce scholarships. Lawmakers also call for steering $318 million to fund LIFE, HOPE and Palmetto Fellows college scholarships, $51 million from the lottery for tuition help and $80 million to pay for tuition grants.

Economic development: The budget calls for an additional $3.7 million in the state’s deal-closing fund to attract more business and $20 million to promote tourism.

Health care: The House budget proposes $20 million more for child welfare programs and $27 million to match federal money for two veteran nursing homes.

Criminal justice: $90 million from federal funding for prison safety upgrades; and $17.9 million for staffing increases and retention needs.

Also in the budget is $17.6 million for the state’s judiciary for an online court project and case management improvements; $2 million for more conservation grants; $5.9 million for health and dental insurance cost increases for state employees; $36 million to boost the employee pension system; and $17.6 million for a local government fund to offset tax losses.

- Have a comment? Send to: feedback@statehousereport.com. Make sure to add your name and contact information for verification.

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!

Pingback: Charleston Currents – NEW for 3/22: On litter cleanup, open carry, state budget

Pingback: Charleston Currents – NEWS BRIEFS: $500 million fund is new to state’s $10 billion spending plan