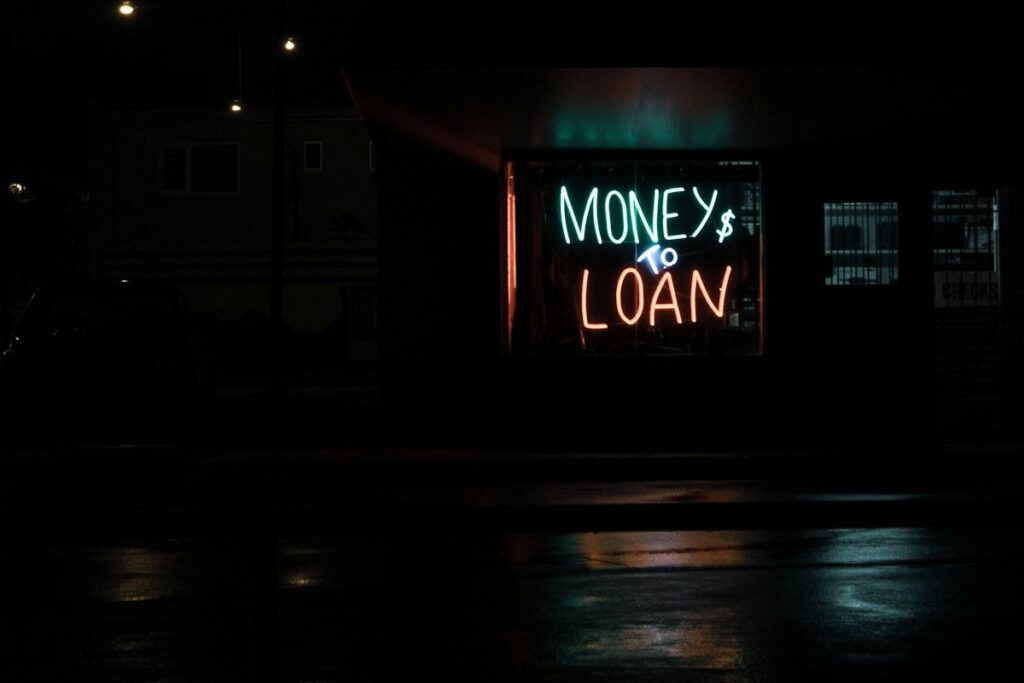

By Jack O’Toole | The primary sponsor of a bill to reform predatory lending practices in South Carolina says recent reports of its death are at least somewhat exaggerated.

“I think there’ve been some good discussions,” Beaufort Republican Senator Tom Davis told Statehouse Report in a Thursday interview. “I don’t know where they’re going to finally end up, but my sense is, they may end up in a place where … we can reach a compromise.”

His bill, dubbed the Predatory Trade Practices Act, aims to rein in what supporters describe as egregious misconduct by some short-term lenders that has saddled some 400,000 South Carolinians with high-interest-rate loans they likely may never be able to repay, according to a 2023 study by Coastal Carolina University.

Despite a bipartisan 10-7 thumbs up for the bill, S. 910, from the Senate Labor, Commerce and Industry Committee, the legislation has been stalled since February 15, when state Sen. Wes Climer, R-York, raised a parliamentary objection when it was introduced on the floor. What that means in practice is that the bill cannot be brought up for debate until either Climer voluntarily lifts his hold or two-thirds of the Senate votes to proceed without his agreement.

Davis, a veteran legislator who knows how to count votes, says the two-thirds option is unlikely. But when asked whether a compromise that could win Climer’s support was still a realistic possibility, he was more optimistic.

“Wes Climer is a very principled lawmaker, and he has some legitimate and valid concerns,” Davis said. “I respect his opinion on this.”

Statehouse Report was unable to reach Climer on Thursday. But chief among his concerns, Davis says, is that current reform efforts, no matter how well-intended, could have the unintended consequence of making it impossible for poorer residents to access credit when they need it most. And while Davis disagrees – he thinks the evidence from states that have reformed predatory lending provides compelling evidence to the contrary – he calls that “an honest difference of opinion.”

In fact, it’s by addressing Climer’s concerns directly, with a sincere willingness to compromise, that Davis believes he may still be able to find a path forward.

Because, regardless of party or ideology, virtually everyone involved agrees on one thing: too many South Carolinians are ending up with loans they can’t possibly pay back.

‘A debt trap they literally never get out of’

Susan Stall is the head of the S.C. Fair Lending Alliance, a statewide coalition of faith-based and nonprofit consumer advocacy organizations that has been working to pass predatory lending reform for the past four years.

She pointed to the Coastal Carolina study to illustrate the scope of the problem – 10% of the state’s adult population with outstanding installment, payday and title loans carrying an average interest rate of 127%. Due to high interest rates, which can exceed 300%, lenders must roll the loans over again and again, paying the interest but never reducing the principal.

“People are getting caught in a debt trap they literally never get out of,” she told Statehouse Report. “They’re not getting a loan and paying it over the original term. It’s just being renewed every two to three months.”

That concern is echoed by Charmaine Fuller Cooper, state director of the American Association of Retired Persons (AARP). She says she regularly sees senior citizens who have lost not just their Social Security checks but also their cars and housing after taking out deceptively advertised loans to pay for prescriptions or other necessities.

“People on fixed incomes are really being taken advantage of,” she said.

To help people understand how that happens, the nonprofit S.C. Appleseed Legal Justice Center uses the following example: A $3,000 loan with a two-year term at 300% APR – again, a not-unheard-of rate in South Carolina – would require the borrower to make 24 payments of $753, for a total of $18,072.

“I’ve been representing low-income borrowers my entire career,” said Appleseed attorney and director of policy Sue Berkowitz. “And it’s just profoundly sad and frustrating to see how much money gets taken from folks who can least afford it in order to make some industries incredibly profitable.”

Nevertheless, other groups in the state share the worry that poor citizens could find themselves cut off from credit entirely if reformers miscalculate.

“(The bill) is a bad deal for consumers,” said Bryce Fiedler, senior policy analyst for the South Carolina Policy Council, a think tank based in Columbia. “For those with subpar credit, it will become harder to learn about or access financial services. These loans fill a gap in the marketplace for non-prime borrowers who aren’t served by banks.”

The outlines of a compromise?

The bill as written avoids a hard cap on interest rates, which senators and advocates agree would be a non-starter in the legislature. Instead, it attempts to achieve reform by regulating four specific industry practices that supporters see as particularly odious:

- The mailing of so-called “live checks” – that is, unsolicited checks that become high-interest loans when cashed or deposited – would be prohibited.

- Strict limits on the number of times a loan can be renewed.

- Lenders would be required to conduct basic due diligence to determine whether a potential borrower could repay a loan before offering it.

- Lenders would no longer be allowed to use sophisticated consumer data mining to market directly to individuals experiencing financial hardships.

Based on his discussions, Davis suspects a potential compromise would probably involve dropping the due diligence and data-driven marketing provisions to save the prohibition on live checks and the limits on renewals.

But any such compromise would have to include industry leaders.

“I want the lending industry to say, ‘This is what we need to do to weed out the bad actors in our industry.’ And I would expect their active support for passing the bill on those amended terms,” Davis said.

- Jack O’Toole reports on statewide issues for Statehouse Report and the Charleston City Paper. Have a comment? Send to: feedback@statehousereport.com.

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!

“But any such compromise would have to include industry leaders.” Why on earth does the industry leaders have any say in it whatever? They’re not making the law! I take that back, of course, they’re making the law. The legislators do what the lobbyists want. The lobbyists pay the legislators to make law.

The first thing that needs to be changed is campaign finance laws!!